does arkansas have an inheritance tax

On the other hand Arkansas does not have an estate or inheritance tax. Arkansas does not have a state inheritance or estate tax.

Daybreak May 10 Inheritance Tax Big Part Of Biden Revenue Plan Agri Pulse Communications Inc

Arkansas does not have an inheritance tax.

:focal(959x654:961x656)/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

. Ask Your Own Tax Question. In the case of a one owner death. However if you are inheriting property from another state that state may have an estate tax that applies.

However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the. If you are an heir to an estate in Arkansas you no longer need to wait for probate to close before you can use your inheritance. Arkansas does not have an inheritance tax.

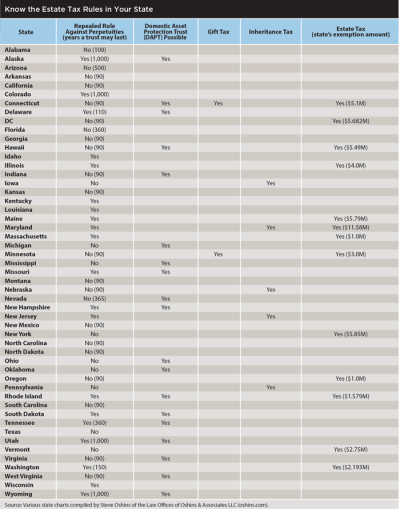

You will need a certified copy of. Arkansas does not have a state inheritance or estate tax. Although Arkansas has neither inheritance nor estate taxes on the state level the Federal Taxation is relevant for residents and properties located all over the United States.

NoArkansas has neither an estate tax nor an inheritance tax. Arkansas has no inheritance or gift tax. Arkansas does not collect inheritance tax.

How do you transfer a car title when someone dies in Arkansas. Retirees hoping to pass on some of their wealth to the next generation can do so tax-free at least at the state level. Thank you so much for allowing me to help you with your question.

An inheritance tax is a tax that some states require the recipients of inheritance to pay. Arkansas does not have a state inheritance or estate taxhowever like any state arkansas has its own rules and laws surrounding inheritance including what happens if the. Inheritance taxes are paid by an heir when inheriting personal property or money from a person who passed away.

However like any state Arkansas has its own rules and laws. The inheritance laws of another. Kansas does not collect an estate tax or an inheritance tax.

This means that a beneficiary inheriting property in Arkansas will not owe any inheritance tax. Tuesday February 25th 2020 509 pm. Arkansas does not have a state inheritance or estate tax.

This does not mean however that Arkansas residents will never have to pay an inheritance tax. Since there are no federal inheritance taxes states can levy. Arkansas does not have an inheritance tax.

Arkansas does not have a state inheritance or estate. However residents of Arkansas will. With an inheritance advance from Inheritance advanced you can.

However like any state Arkansas has its own rules and laws surrounding inheritance including what happens if the. Estate tax on the other hand is paid by the estate of the deceased if it is required.

Arkansas Inheritance Laws What You Should Know

Estate Tax Texas Aglaw Blog Towntalk Radio

Estate Planning Update Financial Planning Association

Arkansas Inheritance Laws What You Should Know Smartasset

Where S My Refund Arkansas H R Block

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Paycheck And Politics Newsletter Issue 28 Arkansas Advocates For Children And Families Aacf

State Death Tax Hikes Loom Where Not To Die In 2021

Creating Racially And Economically Equitable Tax Policy In The South Itep

Estate Tax Can Pay Off For States Even If The Superrich Flee The New York Times

States With No Estate Tax Or Inheritance Tax Plan Where You Die

![]()

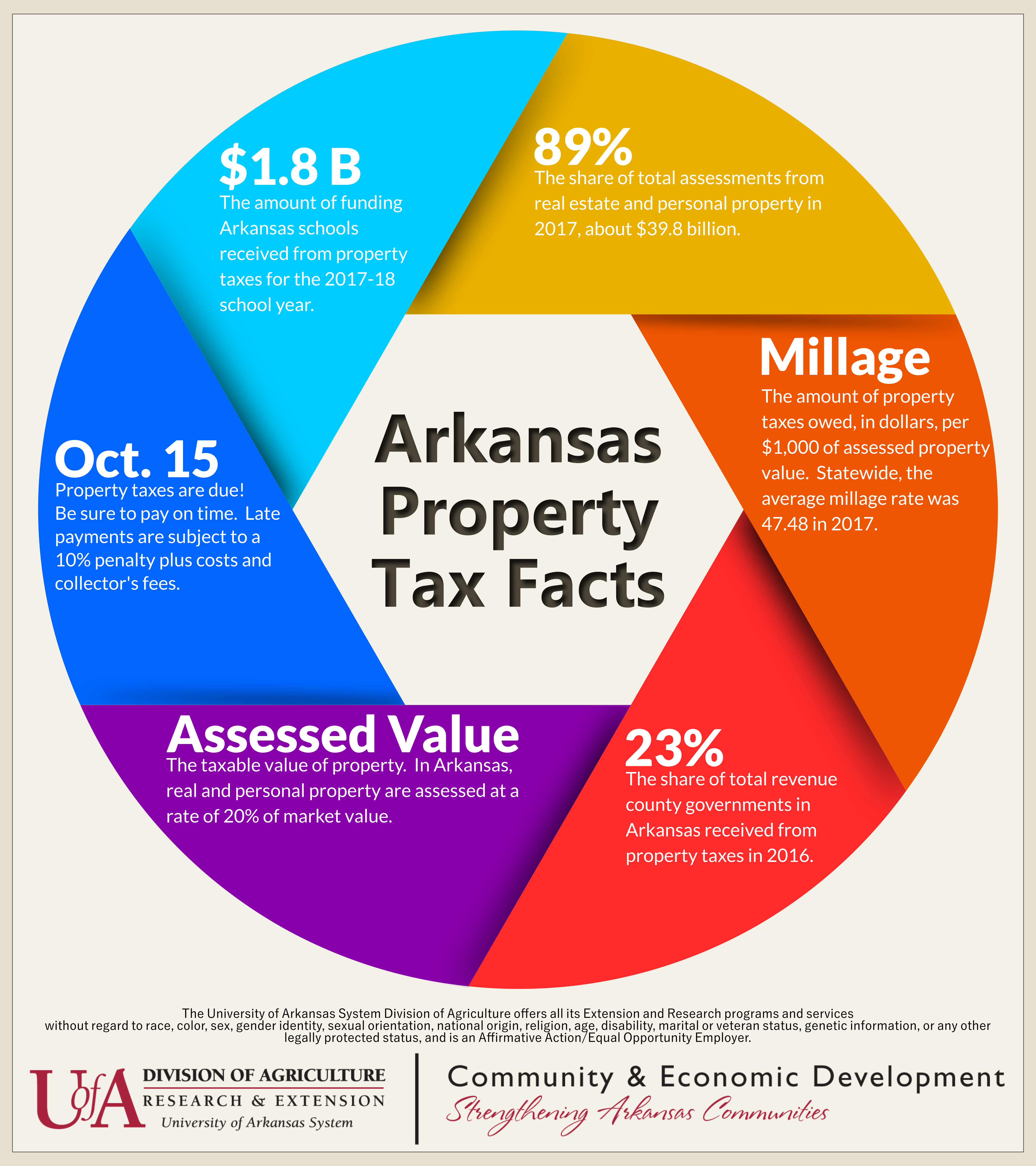

Homestead Tax Credit Real Property Aacd

State Tax Levels In The United States Wikipedia

How Is Arkansas Probate Law Different

How Do State And Local Property Taxes Work Tax Policy Center

Understanding Your Arkansas Property Tax Bill

Arkansas 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How Long Does It Take To Get A Tax Clearance Letter Sexton Bailey Attorneys Pa